Archives

Categories

Simplify Payroll, Streamline HR

Streamlining HR procedures to create a motivated, automated, and committed work environment with MangoHR, your trusted workplace facilitator. MangoHR provides HR software to help companies hire, onboard, evaluate, and pay right.

Creating a workplace your employees love starts with this crucial step for every HR professional.

- Simplified payroll processing

- Time and attendance tracking

- Performance analysis and improvement

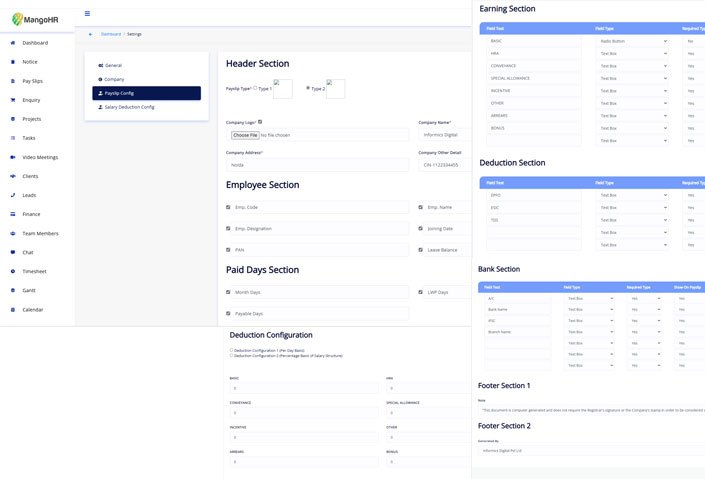

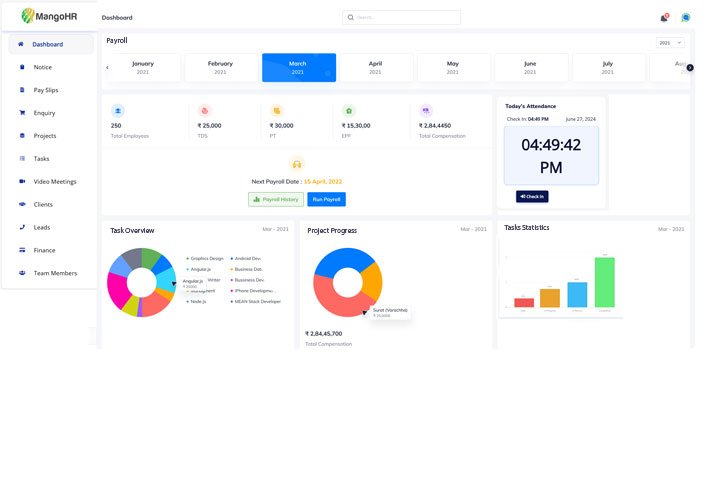

Streamline Payroll Processing

- Say goodbye to tedious manual payroll calculations and endless spreadsheets.

- With MangoHR’s payroll module, processing payroll becomes a breeze.

- The intuitive interface allows for effortless management of employee leaves, compensation, and deductions.

- MangoHR handles it all with precision and accuracy, ensuring timely payments, eliminating errors, and reducing compliance risks.

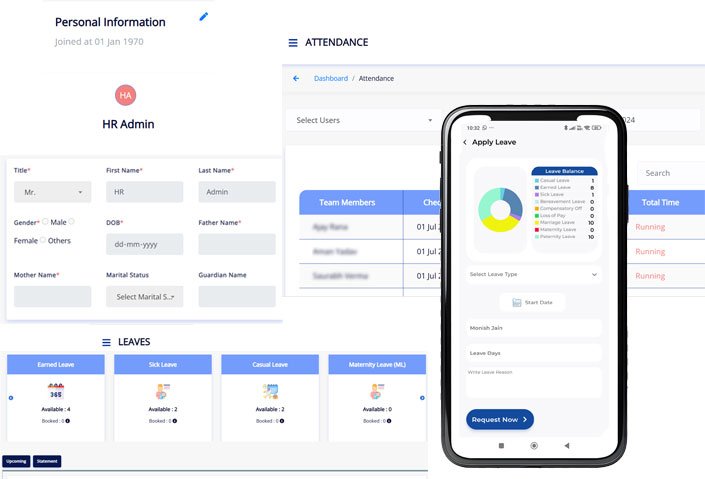

Employee Self-Service Portal

- Empower your employees with MangoHR’s self-service portal.

- Streamline HR tasks with automated management. Access personal information, leave records, attendance, and holidays from anywhere, at any time.

- Easily request time off, update profiles, and view company policies.

By empowering employees with increased control over their data, MangoHR champions transparency and elevates employee engagement.

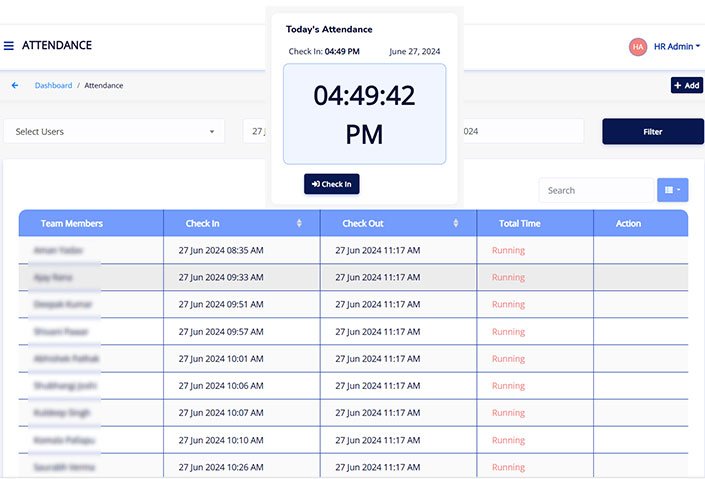

Stay on top of your time: Time and Attendance Tracking

- Keep track of employee hours effortlessly with MangoHR’s time and attendance module.

- Say goodbye to punch cards and manual timesheets. Our advanced time-tracking system enables employees to clock in and out electronically, whether in the office or remotely.

- Managers can quickly review and approve timesheets, monitor attendance trends, and identify potential issues in real-time.

- With MangoHR, inaccurate timekeeping will be a thing of the past.

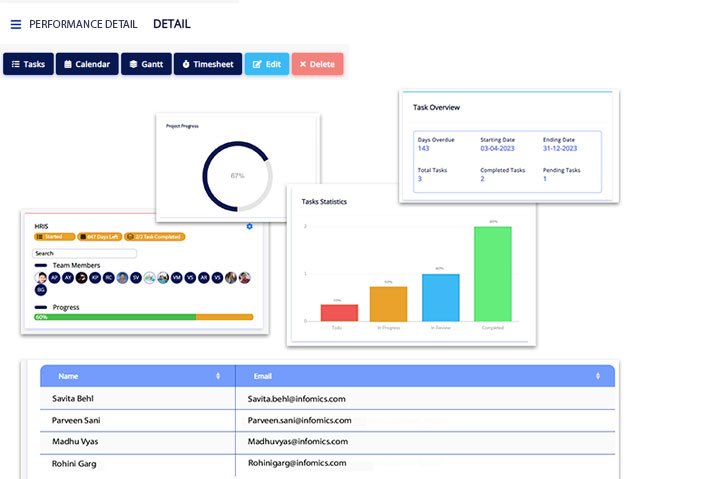

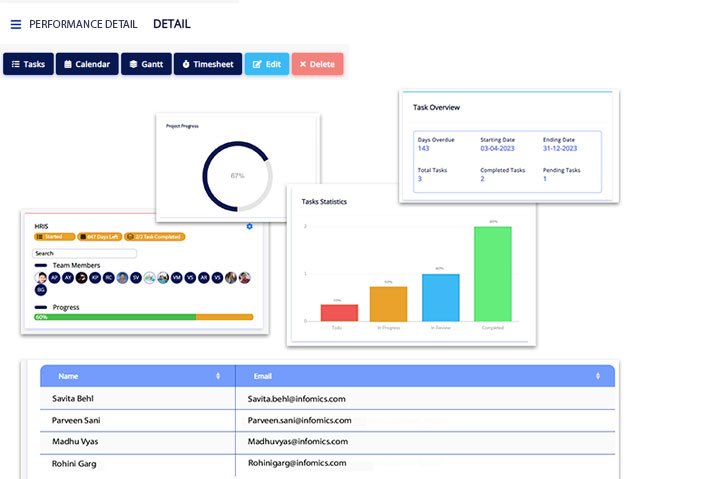

Optimize Performance Management with MangoHR System

- Unlock the full potential of your workforce with MangoHR’s performance tracking feature.

- Reduce the workload of HR in an automated way.

- Set goals, track progress, conduct performance reviews, provide feedback, recognize achievements, and identify areas for improvement with ease.

- MangoHR aligns employee performance with organizational objectives and drives success at every level through automated performance appraisals.

One click is all it takes to send customized invoices to your client’s mailbox, integrated with all popular payment portals such as PayPal, Razor Pay, bank transfer and more.

Experience a comprehensive preview of MangoHR HRMS and payroll software, designed to streamline your HR processes and make payroll management a breeze.

What sets MangoHR apart and makes it stand out from the rest?

For Customers:

- Easily send custom invoices to clients’ and customers’ mailboxes with just one click.

- Our platform also offers seamless integration with popular payment portals like PayPal, Razor Pay, and bank transfers.

For Employees:

- Say goodbye to the hassle of navigating different departments to track leaves, attendance, and holidays.

- Access all the information you need on a single screen, including leave balance, pay details, and employee laws, from anywhere at any time.

For Employers:

- Enjoy hassle-free integration across multiple departments, reducing manual workload and streamlining operations.

Other Features:

- Robust security measures 24/7 dedicated support Suitable for all industry verticals Full HRIS compliance

“MangoHR is trusted by companies ranging from 20 to 20,000 employees.”

FAQs

A digital solution designed for automation and streamlining the process of managing employee compensation. It calculates salaries, deductions and taxes, ensuring accurate, no error and timely payment to employees.

It includes features like direct deposit, tax calculation and self-service portals, simplifying payroll administration for businesses of all sizes. By automating repetitive tasks and ensuring legal compliance with tax and other laws, payroll software saves time, reduces errors and enhances efficiency in managing payroll operations.

A Payroll Management System automates the process of paying employees by handling tasks such as calculating wages, withholding taxes and distributing payments. It works by integrating with different departments as HRIS (Human Resources Information System) and accounting software.

Employees’ work hours, attendance records and salary details are inputted into the system, which then calculates gross wages based on applicable rates and policies. The system automatically deducts taxes, benefits and any other withholdings, generating net pay for each employee.

Once the payroll is processed, the system generates pay stubs, tax forms and other relevant documents for employees and the organization’s records. It also facilitates payment distribution, whether through direct deposit or printed checks. Additionally, the system ensures compliance with legal regulations and tax requirements, helping to mitigate risks and errors associated with manual payroll processing. Overall, a Payroll Management System streamlines payroll operations, improves accuracy, and enhances efficiency within an organization.

- Employee Information Collection: Gathering details like work hours, salary rates, and tax information.

- Timekeeping: Recording employee work hours and attendance.

- Gross Pay Calculation: Determining wages, salaries, and any additional compensation.

- Deduction Calculation: Withholding taxes, benefits, and other deductions.

- Net Pay Calculation: Subtracting deductions from gross pay to calculate the final amount employees receive.

- Payment Distribution: Disbursing pay through methods like direct deposit or printed checks.

- Record Keeping: Maintaining accurate records for tax purposes and compliance.

The main purpose of payroll management software is to automate and streamline the process of paying employees accurately and efficiently. By integrating with various systems such as timekeeping and HRIS, payroll software simplifies tasks like calculating wages, withholding taxes, and processing deductions.

It reduces manual errors, ensures compliance with tax laws and regulations, and facilitates timely payments to employees. Additionally, payroll software often includes features like direct deposit and self-service portals, empowering employees to access their pay information and make updates as needed.

Overall, payroll management software enhances efficiency, accuracy, and compliance in managing payroll operations for businesses.

Of course yes, SMEs do benefit significantly from HR and payroll software. It enhances efficiency in managing HR tasks, payroll processing, and employee records, contributing to overall business growth and success.

Payroll processing software typically includes features such as automated calculation of wages and taxes, direct deposit functionality, employee self-service portals, tax filing assistance, compliance management, reporting and analytics, integration with timekeeping systems, and customization options to meet the specific needs of businesses.

- Manual Payroll: Calculation and processing of payroll done manually without software.

- In-House Payroll: Payroll processing managed internally by the organization using payroll software or spreadsheets.

- Outsourced Payroll: Payroll processing outsourced to a third-party provider who manages all aspects of payroll.

- Online Payroll: Cloud-based payroll software accessed through the internet, offering flexibility and accessibility.

- Integrated Payroll: Payroll software integrated with other HR and accounting systems for seamless data exchange and efficiency.

Each type has its advantages and considerations, allowing businesses to choose the most suitable option based on their needs and resources.

To select the best payroll software solution in India, consider factors such as:

- Features: Ensure it offers essential features like tax calculation, direct deposit, and compliance management.

- Scalability: Choose a solution that can grow with your business.

- User-friendliness: Opt for intuitive software that is easy to use for both HR professionals and employees.

- Customization: Look for software that can be tailored to your specific business needs.

- Integration: Ensure compatibility with other systems like accounting and HRIS.

- Support and Training: Select a provider that offers reliable support and comprehensive training resources.

- Pricing: Compare costs and consider the value offered by each solution.

Employee Self-Service (ESS) integrated with a payroll system offers numerous benefits:

- Empowerment: Allows employees to access and manage their payroll information, reducing reliance on HR.

- Efficiency: Streamlines processes by enabling employees to view pay stubs, update personal information, and request time off electronically.

- Accuracy: Reduces errors associated with manual data entry and ensures that employee information is up-to-date.

- Transparency: Promotes transparency and accountability by providing employees with real-time access to their payroll records.

- Satisfaction: Enhances employee satisfaction by offering greater control and convenience over payroll-related tasks, ultimately boosting morale and engagement within the organization.

Smart organizations choose smart HR tools like MangoHR

MangoHR client sales management feature is perfect for businesses of all sizes. Whether you are a small business owner or a sales manager in a large corporation, With MangoHR client payments and invoicing feature, you can streamline your payment collection process, save time and hassle, and improve your cash flow management. Get started with MangoHR today!